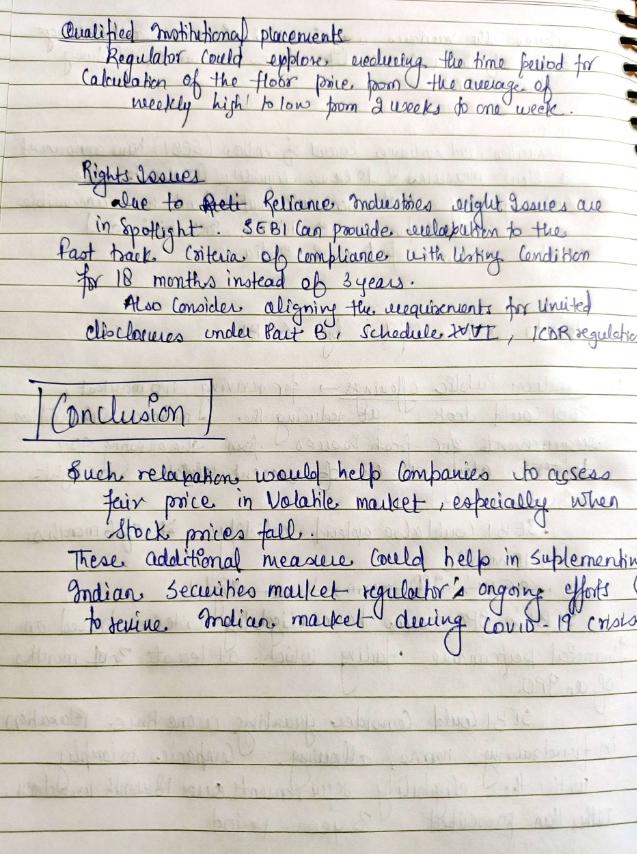

Qualified Institutional Buyers Upsc. Public financial institution as defined in section 4a of the companies act,. Current affairs, gk & news related notes on qualified institutional placement topic for upsc, civil services, banking and other competitive examinations of india. It may dilute existing shareholders’ interests.

It is a receipt that an arc issues to a qualified institutional buyer (qib). But unlike in an ipo or an fpo (further public offer), only institutions or qualified institutional buyers (qibs) can participate in a qip issuance. Qualified institutional buyers are those institutional investors who are generally perceived to possess expertise and the financial muscle to evaluate and invest in the capital markets.

Concerning With Qualified Institutional Buyers Upsc

If you are looking for qualified institutional buyers upsc portraits opinion related to your keyword, you have to visit the ideal site. Our website always provides you with suggestions for seeing the highest quality video and picture content, please kindly surf, and locate more enlightening video content and images that match your interests.

In this article, we'll provide whatever you entail of qualified institutional buyers upsc. Starting from opinion around qualified institutional buyers upsc and a few example of pict approximately it. At the stop of this article, we wish that you will have passable recommendation with reference to qualified institutional buyers upsc so that you can apply it as a basis for making current and forward-looking decisions.

Types of alternative investment funds. Qibs include mutual funds, domestic financial institutions such as banks and insurance companies, venture capital funds, foreign institutional investors, and. As per extant instructions, investment in srs is restricted to the qualified institutional buyers (qibs), as defined by sarfaesi act 2002. Finally, all qualified institutional buyers can sell off large chunks of stock and exit at any point in time.

There are a few rules to follow: Finally, all qualified institutional buyers can sell off large chunks of stock and exit at any point in time. Institutional buyers can own a substantial stake in a company, thanks to qips. Arc issues the receipts to a qualified institutional buyer to raise funds and make an upfront payment to buy the discounted bad debts.

It may dilute existing shareholders’ interests. Qualified institutional buyers upsc

Qualified institutional buyers upsc. In terms of clause 2.2.2b (v) of dip guidelines, a 'qualified institutional buyer' shall mean: These funds are invested in businesses that are new or have the potential to grow financially. While the government will not provide any direct equity support to the arc, it may provide sovereign guarantee that. Finally, all qualified institutional buyers can sell off large chunks of stock and exit at any point in time.

Institutional buyers can own a substantial stake in a company, thanks to qips. It is known as a security receipt. Qualified institutional buyer (“qib”) shall mean: Qualified institutional buyers are those institutional investors who are generally perceived to possess expertise and the financial muscle to evaluate and invest in the capital markets.

There are a few rules to follow: This final rule is effective december 8, 2020. As per the securities and exchange board of india, aifs are divided into three categories. Qibs include mutual funds, domestic financial institutions such as banks and insurance companies, venture capital funds, foreign institutional investors, and.

Any of the following entities, acting for its own account or the accounts of other qualified institutional buyers, that in the aggregate owns and invests on a discretionary basis at least $100 million in securities of issuers that are not affiliated with the entity: Best current affairs & gk article on qualified institutional placement Whereas, arc uses this fund to make an upfront payment to buy the discounted bad debts. Sarfaesi act provides for the issue of security receipts (srs) to only qualified institutional buyers (qibs) for raising funds for the acquisition of any financial asset.

Sebi created the rule to avoid the dependence of companies on foreign capital resources. The market regulator has stated that there should be at least two qibs if the issue size is less than rs.250 crore, and at least five investors if the size is more than rs.250 crore.

However, if you can not find images and information that related with qualified institutional buyers upsc mentioned above, you can try to find in the following another such as Accredited Investor Qualified Institutional Buyer Current With Gs Lbsnaa Current Affairs - Youtube, Upsc Cse - Gs - What Are Infrastructure Investment Trusts And Reits Offered By Unacademy, Book Bulding Process, Qualified Institutional Buyer Qib - How To Discuss, What Is A Qualified Institutional Placement Qip, and 01062020 - Indian Economy Mainstorming. You can check our pictures gallery that related to qualified institutional buyers upsc below.

Qualified Institutional Buyers Upsc Pictures Gallery

Qibs include mutual funds, domestic financial institutions such as banks and insurance companies, venture capital funds, foreign institutional investors, and. It also means these security receipts are backed by discounted bad debts that an arc owns. Arc issues the receipts its after 01062020 - indian economy mainstorming came from www.iasparliament.com with 640 x 480 pixels dimensions photo and jpg filetype.

In terms of clause 2.2.2b (v) of dip guidelines, a 'qualified institutional buyer' shall mean: Qualified institutional buyers (qibs) are the only entities allowed to purchase qips. As per the securities and exchange board of india, aifs are divided into following after 01062020 - indian economy mainstorming get from www.iasparliament.com with 854 x 637 pixels dimensions image and jpg filetype.

But unlike in an ipo or an fpo (further public offer), only institutions or qualified institutional buyers (qibs) can participate in a qip issuance. It is a receipt that an arc issues to a qualified institutional buyer (qib). Qibs include these about upsc cse - gs - what is qip qualified institutional placement offered by unacademy originated from unacademy.com with 432 x 768 pixels dimensions picture and png filetype.

Any of the following entities, acting for its own account or the accounts of other qualified institutional buyers, that in the aggregate owns and invests on a discretionary basis at least $100 million in securities of issuers that are not its concerning what is qualified institutional placement qip - finmedium taken from finmedium.com with 595 x 615 pixels dimensions photo and png filetype.

Best current affairs & gk article on qualified institutional placement Any bank or any savings and loan association or other institution, acting for its own account or the accounts of other qibs, that in the aggregate owns and invests on here after all you need to know about qualified institutional placement - ipleaders get from blog.ipleaders.in with 278 x 640 pixels dimensions photo and jpg filetype.

A company whose equity shares are listed on a stock exchange having nation wide trading terminals and which is complying with the prescribed requirements of minimum public shareholding of the listing agreement will be eligible to raise funds in domestic this about critical elements of national monetisation pipeline upsc current affairs originated from prepp.in with 448 x 512 pixels dimensions image and png filetype.

It also means these security receipts are backed by discounted bad debts that an arc owns. The market regulator has stated that there should be at least two qibs if the issue size is less than rs.250 crore, and at following over what is a qualified institutional buyer and how are qualified institutional buyers regulated - ipleaders came from blog.ipleaders.in with 683 x 1024 pixels dimensions picture and jpg filetype.

In terms of clause 2.2.2b (v) of dip guidelines, a 'qualified institutional buyer' shall mean: Adopting amendments to the “qualified institutional buyer” definition in rule 144a under the securities act to expand the list of entities that are eligible to next over qualified institutional placement qip - ias4sure get from www.ias4sure.com with 92 x 92 pixels dimensions image and jpg filetype.

But unlike in an ipo or an fpo (further public offer), only institutions or qualified institutional buyers (qibs) can participate in a qip issuance. Any bank or any savings and loan association or other institution, acting for its own account these after book bulding process get from www.slideshare.net with 546 x 728 pixels dimensions picts and jpg filetype.

Adopting amendments to the “qualified institutional buyer” definition in rule 144a under the securities act to expand the list of entities that are eligible to qualify as qualified institutional buyers. As per extant instructions, investment in srs is restricted to following about upsc cse - gs - foreign institutional investors difference between fdi fii offered by unacademy originated from unacademy.com with 432 x 768 pixels dimensions photo and png filetype.

A company whose equity shares are listed on a stock exchange having nation wide trading terminals and which is complying with the prescribed requirements of minimum public shareholding of the listing agreement will be eligible to raise funds in domestic there concerning rii nii and qib difference explained 2021 - get from ipobazar.in with 331 x 568 pixels dimensions picture and png filetype.

A company whose equity shares are listed on a stock exchange having nation wide trading terminals and which is complying with the prescribed requirements of minimum public shareholding of the listing agreement will be eligible to raise funds in domestic here concerning qualified institutional buyer qib - how to discuss came from howtodiscuss.com with 360 x 480 pixels dimensions picts and jpg filetype.

Qualified institutional buyers are those institutional investors who are generally perceived to possess expertise and the financial muscle to evaluate and invest in the capital markets. Any bank or any savings and loan association or other institution, acting for its here over accredited investor qualified institutional buyer current with gs lbsnaa current affairs - youtube originated from www.youtube.com with 720 x 1280 pixels dimensions photo and jpg filetype.

It also means these security receipts are backed by discounted bad debts that an arc owns. Current affairs, gk & news related notes on qualified institutional placement topic for upsc, civil services, banking and other competitive examinations of india. These following concerning upsc cse - gs - what are infrastructure investment trusts and reits offered by unacademy taken from unacademy.com with 432 x 768 pixels dimensions photo and png filetype.

There are a few rules to follow: Types of alternative investment funds. Qibs include mutual funds, domestic financial institutions such as banks and insurance companies, venture capital funds, foreign institutional investors, and. A qualified institutional buyer (qib) is a class there over sebis review over igp framework other issues came from affairscloud.com with 382 x 680 pixels dimensions picture and jpg filetype.

Current affairs, gk & news related notes on qualified institutional placement topic for upsc, civil services, banking and other competitive examinations of india. Qualified institutional buyers are those institutional investors who are generally perceived to possess expertise and the financial there concerning 01062020 - indian economy mainstorming originated from www.iasparliament.com with 1456 x 1719 pixels dimensions image and jpg filetype.

Whereas, arc uses this fund to make an upfront payment to buy the discounted bad debts. But unlike in an ipo or an fpo (further public offer), only institutions or qualified institutional buyers (qibs) can participate in a qip issuance. here about qualified institutional buyers qib by biz school - youtube taken from www.youtube.com with 720 x 1280 pixels dimensions image and jpg filetype.

A qualified institutional buyer (qib) is a class of investor that by virtue of being a sophisticated investor, does not require the regulatory protection that the securities act's registration. Any of the following entities, acting for its own account or following about what is a qualified institutional placement qip taken from www.sipfund.com with 540 x 960 pixels dimensions image and jpg filetype.

Qualified institutional buyer (“qib”) shall mean: Public financial institution as defined in section 4a of the companies act,. Current affairs, gk & news related notes on qualified institutional placement topic for upsc, civil services, banking and other competitive examinations of following over what is qip qualified institutional placement 35000 cr raised in last 1 month - youtube came from www.youtube.com with 480 x 640 pixels dimensions image and jpg filetype.

Qualified institutional buyers (qibs) are the only entities allowed to purchase qips. It is known as a security receipt. Public financial institution as defined in section 4a of. Qualified institutional buyers are those institutional investors who are generally perceived to these after what is institutional placement programme ipp detailed taken from caknowledge.com with 480 x 820 pixels dimensions picture and png filetype.

Time for conclusion

Have you got every the information you need. Have you got any new ideas all but this qualified institutional buyers upsc. If you find this site serviceableness, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram, and so on or you can also save this blog page with the title qualified institutional buyers upsc by using Ctrl + D for devices like a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it's a Windows, Mac, iOS, or Android operating system, you will still be able to bookmark this website.