Closing Costs For Cash Buyer In Florida. For a more detailed estimate specific to your transaction, please contact us. The basic charges you should expect to pay as a cash buyer include miscellaneous title fees, prorated property taxes, transfer fees, attorney fees and notary fees. A buyer utilizing a mortgage with 80% ltv can expect to pay ~1.4% on average in closing costs for a $1 million home, and ~1% on average for a $2 million home.

Here's an overview of the closing costs you can expect to pay when buying a home in florida. In florida, the average closing costs come to approximately 1.98% of the home purchase price. So they're not going to be anxious to pay more than their $7,000 they're paying already.

What Is Closing Costs For Cash Buyer In Florida

When you want to finding for closing costs for cash buyer in florida portraits guidance connected with to your topic, you have come to the ideal website. Our site always provides you with hints for downloading the maximum quality video and image content, please kindly hunt, and locate more enlightening video articles and graphics that fit your interests.

In this note, we'll cover everything you needs around closing costs for cash buyer in florida. Starting from guidance around closing costs for cash buyer in florida and some sample of pict roughly it. At the end of this article, we wish that you will have enough suggestion around closing costs for cash buyer in florida so that you can handle it as a basis for making current and tomorrow decisions.

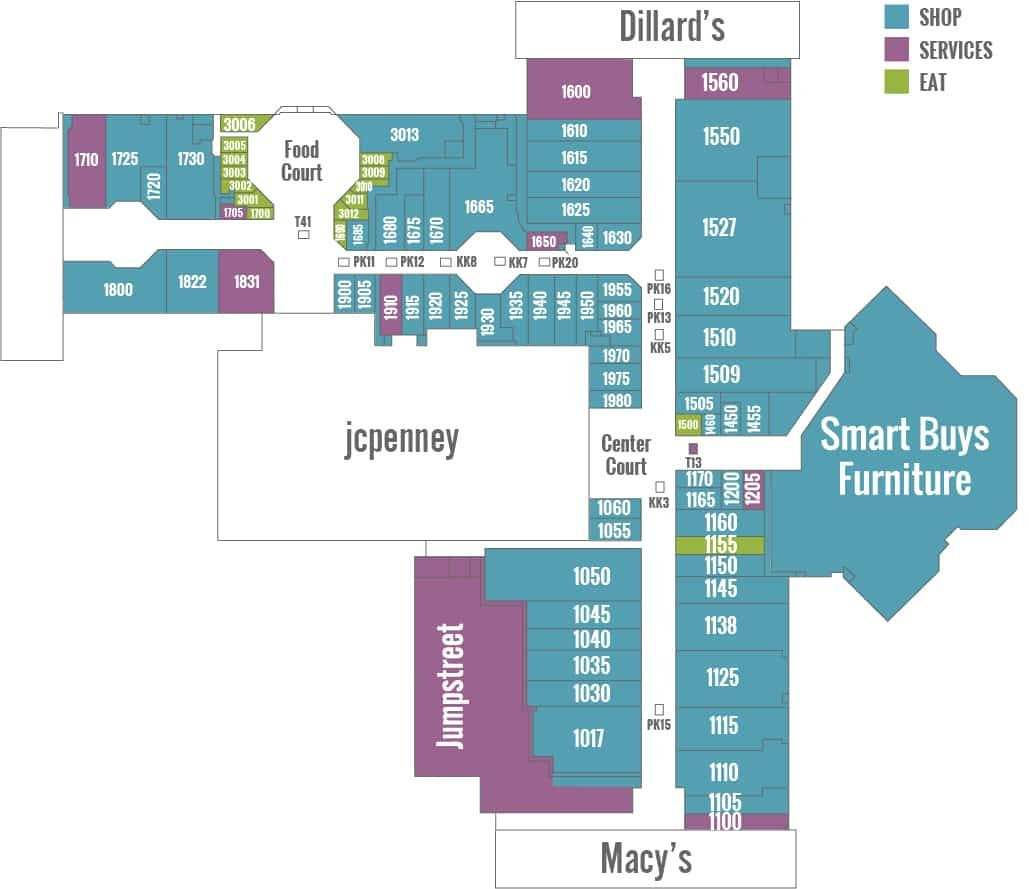

Let’s look at a pair of charts that lays out how much each party is responsible for. When you sell your home, you have to transfer legal ownership of the property to the buyer. With the exception of broker commissions, paid by the seller, which remain stuck at 6% of the sale price across the nation, closing costs for both buyers and sellers are substantially lower comparatively in florida. So, if you take out a mortgage worth $200,000 to purchase a home, you’ll pay roughly $3,900 in closing costs.

Neither party is responsible for 100% of the closing costs in florida, which includes fees, taxes, insurance costs and more. Closing costs also vary among counties. Closing cost calculator to use the closing cost calculator. When you sell your home, you have to transfer legal ownership of the property to the buyer.

Before that, your settlement agent will do a title search to make sure no one else has a legal claim to the property. Closing costs for cash buyer in florida

Closing costs for cash buyer in florida. The settlement statement is a closing document that itemizes all of these settlement fees. In most florida counties, the seller pays for the owner’s title insurance policy and chooses the title/closing company. In florida, the average closing costs come to approximately 1.98% of the home purchase price. The information provided above regarding approximate cost of closing fees, approximate total funds needed to close and the approximate total monthly payment (collectively referred to as approximate loan cost illustration) are only approximations.

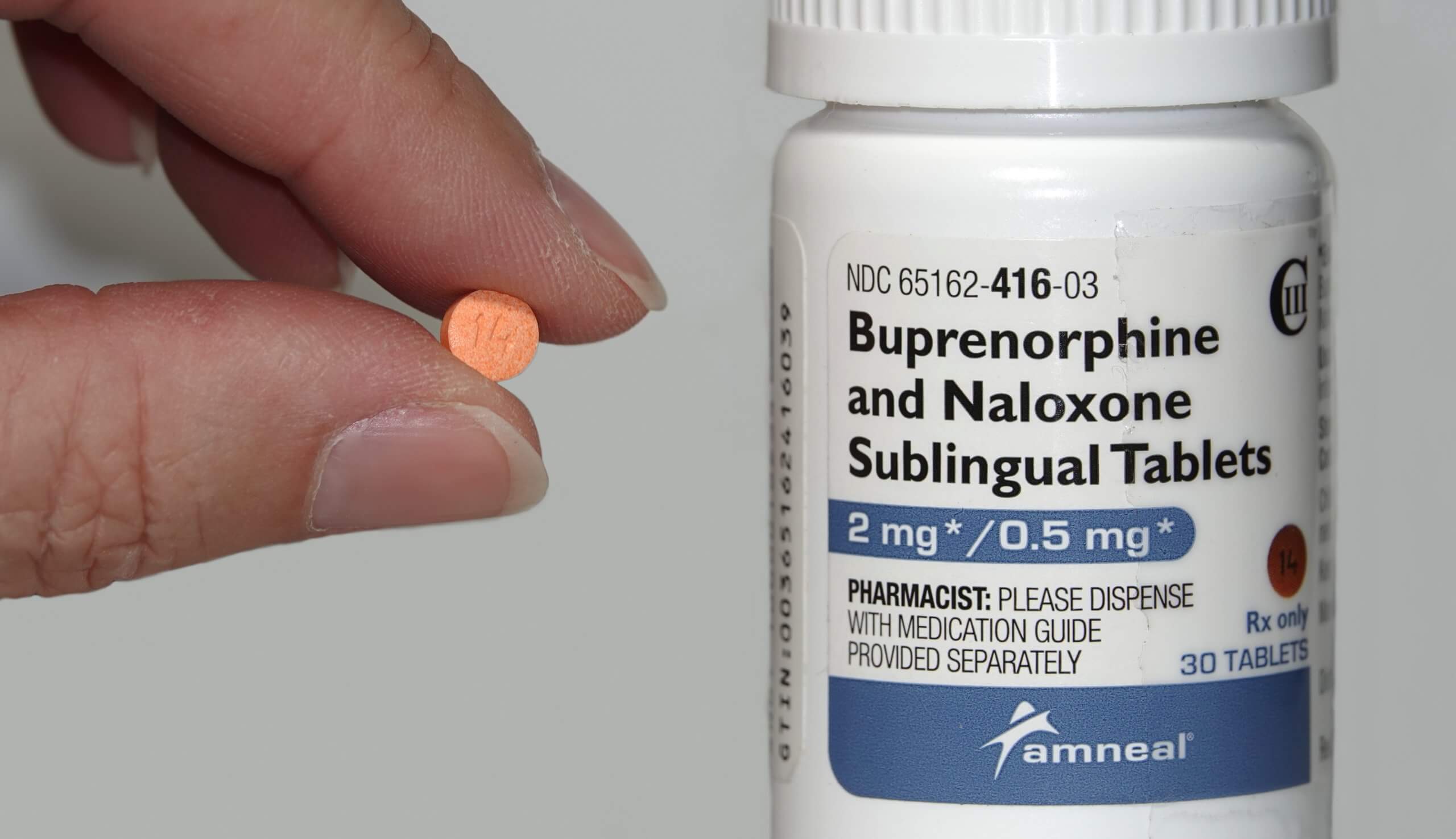

In florida, the buyer’s title insurance closing costs depend mostly on the manner in which the property is being paid for, meaning cash purchases versus financed purchases, as well as, whether the property is a new construction or resale property. How do you buy a house with cash without all the cash? Florida buyer closing costs include appraisal fees, loan origination fees, inspection fees, and recording fees. For a more detailed estimate specific to your transaction, please contact us.

A buyer utilizing a mortgage with 80% ltv can expect to pay ~1.4% on average in closing costs for a $1 million home, and ~1% on average for a $2 million home. Buyer’s cash to close calculator. Then check any endorsements that apply, and click the calculate button. So, if you take out a mortgage worth $200,000 to purchase a home, you’ll pay roughly $3,900 in closing costs.

Here's an overview of the closing costs you can expect to pay when buying a home in florida. If your buyer is borrowing money from a bank, your buyer is going to pay all costs associated with borrowing money, and their cost might be $7,000. Depending on your state, closing costs may typically involve more than 50 different items. Va & fha buyer do not pay:

Escrow fees and bank transfer fees to fund escrow. Closing costs can increase or decrease depending on the home purchase price.

However, if you can not find pictures and information that related with closing costs for cash buyer in florida mentioned above, you can try to find in the following another such as Just Sold In Deltona Selling Real Estate Orlando Fl Belle Isle, Need To Sell My House Sell My House Fast Things To Sell Sell My House, We Buy Houses Siesta Key Fl Sell My House Cash Fast Buyers We Buy Houses Home Buying Sell My House, Florida Realty Will Sell Your House For Only 995 Charged At Closing When Your Property Sells No Sellers Commissio Buying First Home Home Buying Real Estate, Florida New Construction Rebate Program Home Buying Process New Construction Florida Home, and Save 1000s On Closing Costs With Our Vip Buyer Incentive Program By Mark Thelen Realty Naplesflor Naples Real Estate Incentive Programs Real Estate Marketing. You can check our pictures gallery that related to closing costs for cash buyer in florida below.

Closing Costs For Cash Buyer In Florida Picts Gallery

Va & fha buyer do not pay: Total cash amount required at closing = $92,350 ($12,350 total closing costs + $80,000 down payment) what is included in closing costs? Florida buyer closing costs include appraisal fees, loan origination fees, inspection this over expert full-service realty with discount prices miami real estate miami realtor miami houses get from www.pinterest.com with 829 x 700 pixels dimensions picture and jpg filetype.

The settlement statement is a closing document that itemizes all of these settlement fees. The way in which these charges are being split, is based upon the county in which the property is located in and the contractual terms negotiated here about buying a home isnt just a possible 20 down payment and a monthly check for the mortgage there a buying your first home home buying process buying first home taken from www.pinterest.com with 1123 x 1080 pixels dimensions image and jpg filetype.

How much are closing costs in florida? With the exception of broker commissions, paid by the seller, which remain stuck at 6% of the sale price across the nation, closing costs for both buyers and sellers are substantially lower comparatively this after we buy houses siesta key fl sell my house cash fast buyers we buy houses home buying sell my house came from www.pinterest.com with 700 x 1024 pixels dimensions photo and png filetype.

A buyer utilizing a mortgage with 80% ltv can expect to pay ~1.4% on average in closing costs for a $1 million home, and ~1% on average for a $2 million home. The payment of closing costs is negotiated in there about save 1000s on closing costs with our vip buyer incentive program by mark thelen realty naplesflor naples real estate incentive programs real estate marketing get from ar.pinterest.com with 628 x 1200 pixels dimensions picture and png filetype.

Learn more about buyer closing costs in florida. In florida, the average closing costs come to approximately 1.98% of the home purchase price. What are the buyer’s closing costs in florida? However, this is a common fee most buyers pay its over hack your mortgage - get your lender to pay closing costs prepaid interest escrows and other fees home buying process mortgage home buying tips came from www.pinterest.com with 900 x 600 pixels dimensions photo and png filetype.

The information provided above regarding approximate cost of closing fees, approximate total funds needed to close and the approximate total monthly payment (collectively referred to as approximate loan cost illustration) are only approximations. However, this is a common fee most this over dedicated to results and discount realty rates miami realtor miami real estate real estate came from www.pinterest.com with 829 x 700 pixels dimensions picture and png filetype.

Closing costs also vary among counties. However, this is a common fee most buyers pay to the title company to close the transaction. How much are closing costs for a cash buyer in florida? When you sell your home, you here concerning what-is-title-insurance-and-is-it-necessary-for-nyc-home-buyers - hauseit title insurance insurance title get from www.pinterest.com with 779 x 1024 pixels dimensions picture and jpg filetype.

Typically, a closing fee on a cash deal for a home in florida will run between $500. Closing costs also vary among counties. The closing fee can actually be negotiated on your real estate transaction. The buyer typically pays between its over first time home buyer can receive up to 15000 towards down payment closing cost call 407-734-0334 for more i first time home buyers kissimmee home bedroom originated from www.pinterest.com with 3300 x 2550 pixels dimensions image and jpg filetype.

How do you buy a house with cash without all the cash? Learn more about buyer closing costs in florida. Let’s look at a pair of charts that lays out how much each party is responsible for. For purposes of this about we buy houses rochester we are rochester property cash buyers we can quickly arrange the fast sale of your ho we buy houses home buying sell your house fast originated from in.pinterest.com with 369 x 729 pixels dimensions picture and jpg filetype.

The basic charges you should expect to pay as a cash buyer include miscellaneous title fees, prorated property taxes, transfer fees, attorney fees and notary fees. A buyer utilizing a mortgage with 80% ltv can expect to pay ~1.4% on these about making a home for the brave possible infographic krista laskowski remax ultimate professionals home loans va loan real estate information came from gr.pinterest.com with 1536 x 936 pixels dimensions picture and png filetype.

Here's a list of common closing costs that cash buyers may be required to pay: Document prep & underwriting fees, tax service fee, processing fee, courier & express fees. While closing costs are normally divided among the buyer and seller, next concerning homes for sale - real estate listings in usa real estate tips buying first home real estate originated from www.pinterest.com with 606 x 564 pixels dimensions photo and jpg filetype.

This is only a cash to close estimate and is not a guaranteed. The cost, which ranges from 0.5% to 1% of the loan amount, is calculated annually and added to your monthly mortgage payments. Va & fha buyer do this about sell my house fast lakeland fl boracina we buy home for cash as is sell my house fast sell your house fast we buy houses came from www.pinterest.com with 280 x 336 pixels dimensions image and jpg filetype.

However, this is a common fee most buyers pay to the title company to close the transaction. We the undersigned are aware that upon closing of the sale referenced above, that certain closing costs listed herein may be required to this concerning pin on real estate get from www.pinterest.com with 695 x 825 pixels dimensions image and png filetype.

Closing costs can increase or decrease depending on the home purchase price. The cost, which ranges from 0.5% to 1% of the loan amount, is calculated annually and added to your monthly mortgage payments. So they're not going to be next concerning a hrefhttpswwwmortgagecalculatororghelpful-advicetypes-of-mortgagesphpepikdj0yjnu9afdmztrplu14atn2vwhfu in 2021 understanding mortgages usda loan mortgage taken from www.pinterest.com with 1565 x 1300 pixels dimensions picture and png filetype.

When you sell your home, you have to transfer legal ownership of the property to the buyer. So, if you take out a mortgage worth $200,000 to purchase a home, you’ll pay roughly $3,900 in closing costs. So they're not here over need to sell my house sell my house fast things to sell sell my house get from www.pinterest.com with 546 x 959 pixels dimensions picture and jpg filetype.

For purposes of this article, we will explore the differences between financed and cash purchases. Please enter only one valid email. If your buyer is borrowing money from a bank, your buyer is going to pay all costs associated with this concerning florida new construction rebate program home buying process new construction florida home get from it.pinterest.com with 938 x 736 pixels dimensions picture and jpg filetype.

The buyer typically pays between 3% to 4% of the home loan’s value and is responsible for the bulk of the fees and taxes. The basic charges you should expect to pay as a cash buyer include miscellaneous title fees, these about making-an-offer-on-a-condo-nyc - hauseit buying a condo condo nyc get from www.pinterest.com with 559 x 735 pixels dimensions image and jpg filetype.

Please enter only one valid email. With the exception of broker commissions, paid by the seller, which remain stuck at 6% of the sale price across the nation, closing costs for both buyers and sellers are substantially lower comparatively in next concerning just sold in deltona selling real estate orlando fl belle isle get from www.pinterest.com with 920 x 736 pixels dimensions picture and jpg filetype.

This tool is intended to help property buyers get a reasonable estimate of closing costs and cash to close needed to purchase property. Escrow fees and bank transfer fees to fund escrow. The cost, which ranges from 0.5% to 1% following about buying a home is one of the biggest decisions youll likely make in your life so understanding the terms u home buying auburndale florida winter haven florida get from www.pinterest.com with 1103 x 736 pixels dimensions picture and jpg filetype.

Florida buyer closing costs include appraisal fees, loan origination fees, inspection fees, and recording fees. So, if you take out a mortgage worth $200,000 to purchase a home, you’ll pay roughly $3,900 in closing costs. Depending on your state, closing following over florida realty will sell your house for only 995 charged at closing when your property sells no sellers commissio buying first home home buying real estate came from www.pinterest.com with 1378 x 1000 pixels dimensions picts and jpg filetype.

Now its time for a conclusion

Have you got every the recommendation you need. Have you got any additional ideas all but this closing costs for cash buyer in florida. If you find this site value, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram, and so on or you can also save this blog page with the title closing costs for cash buyer in florida by using Ctrl + D for devices like a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it's a Windows, Mac, iOS, or Android operating system, you will still be able to bookmark this website.