Buy To Close Covered Call. A buy/write order contains stock and an option. There are essentially two primary situations in which it may make sense to close out a profitable covered call trade early. All you are simply doing is buying back the option or options you ‘sold to open’ trade.

Buy some of the further out ones too. You would still own the underlying 100 shares but you would be free to either keep them or dispose of them as you saw fit. It can be done in a cash or a margin account.

Connected to Buy To Close Covered Call

For all who seeking for buy to close covered call pictures recommendation related to your interest, you have visit the ideal website. Our website frequently gives you suggestions for downloading the maximum quality video and image content, please kindly search, and find more informative video content and images that fit your interests.

In this article, we'll give everything you need on buy to close covered call. Starting from opinion to buy to close covered call and some sampling of image approximately it. At the end of this article, we wish that you will have enough counsel regarding buy to close covered call so that you can adopt it as a basis for making current and future decisions.

You wont see it in your account and you have no risk(don't have to wait until exp). The investor sells to open another call near the end of the market day. This provides you with unlimited profit potential on the trade while limiting the risk to the price paid for the option to open the position. However, that's not the best way to close the position, regardless of the type of account involved.

Whereas before you sold to open, now you buy to close the short call, in effect canceling it out. You wont see it in your account and you have no risk(don't have to wait until exp). You would still own the underlying 100 shares but you would be free to either keep them or dispose of them as you saw fit. However, that's not the best way to close the position, regardless of the type of account involved.

We buy back the short calls and sell the underlying stock. Buy to close covered call

Buy to close covered call. In market parlance, it is understood to mean that the trader wants to close out. If you are short (sold) a call, you have to “buy to close that same exact call to close your position. The call option will increase in value as the stock moves higher. The ‘sell to open’ and ‘buy to close’ orders are the orders we use when implementing our strategy of writing covered calls.

When the stock is vulnerable to a decline If you want to e. When the stock price goes below the original price, when the underlying was purchased,there is no risk of losing the underlying due to the call not being exercised, however the call seller does have the option of “rolling ” the option and if necessary choose a different strike price….if the call seller believes the underlying will be trading at a lower price… If you own a put, you have to “sell to close exactly the same put.

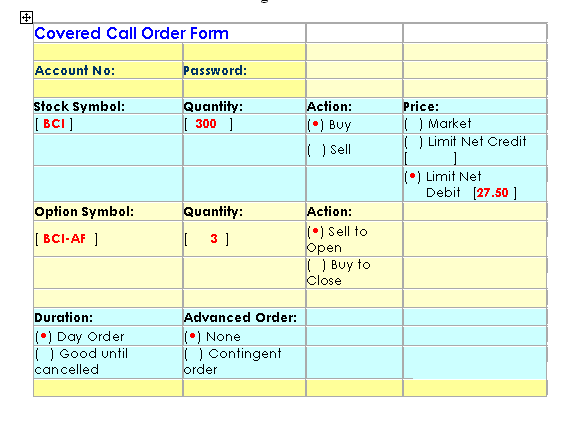

It can be done in a cash or a margin account. For establishing a covered call (assuming that you don't already own the stock), this means buying the stock and selling the call in one order. The investor sells to open another call near the end of the market day. If you buy(to close) the same calls you sold it closes your position completely.

We buy back the short calls and sell the underlying stock. So closing a covered call before it expires is as simple as doing the opposite as you did when you initiated the position. 'buy to close' refers to terminology that traders, primarily option traders, use to exit an existing short position. You would still own the underlying 100 shares but you would be free to either keep them or dispose of them as you saw fit.

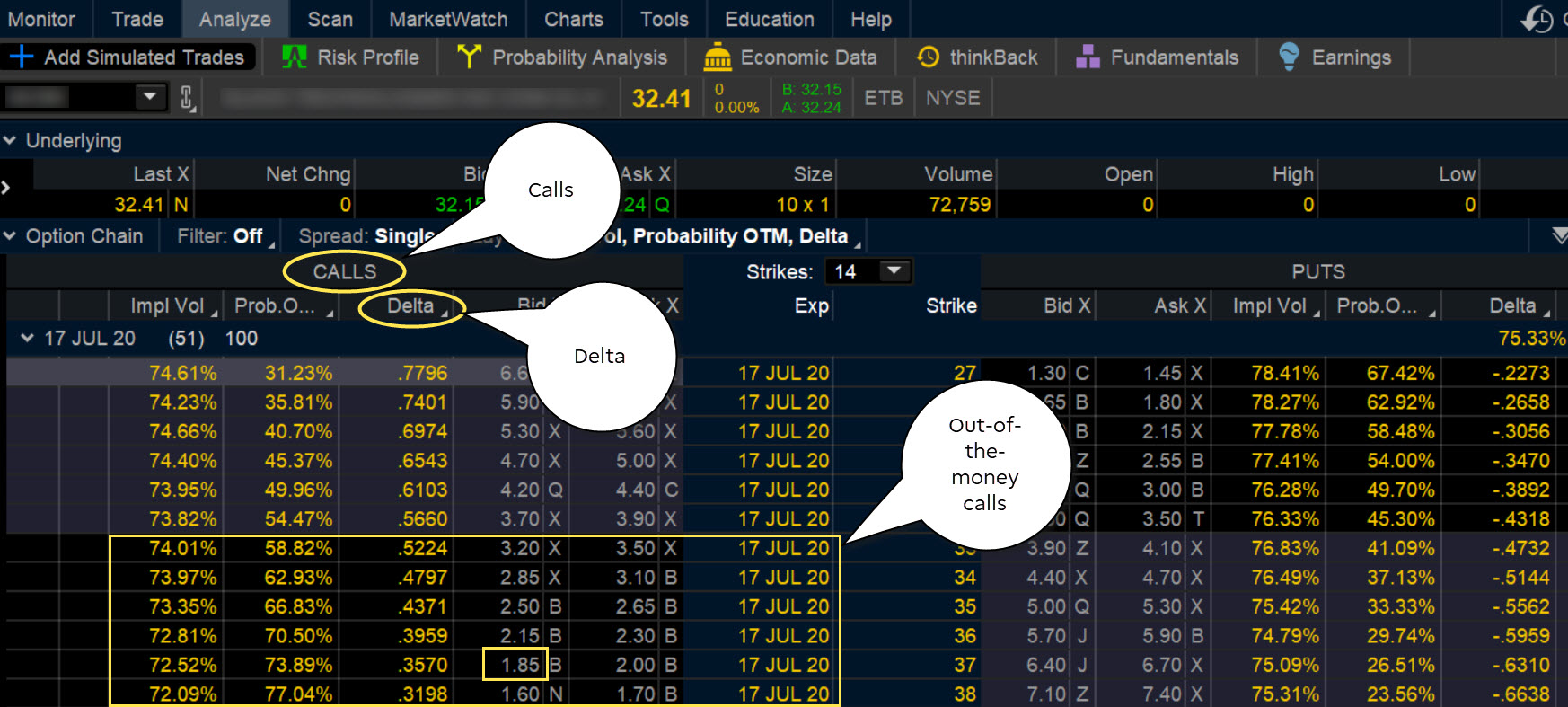

Instead our offer will be $2.65. So closing a covered call before it expires is as simple as doing the opposite as you did when you initiated the position.

However, if you can not find pictures and information that related with buy to close covered call mentioned above, you can try to find in the following another such as Executing Covered Call Trades The Buy-write Combination Form The Blue Collar Investor, Executing A Covered Call Writing Trade With The Buy-write Combination Form Seeking Alpha, Covered Calls Option Trading Guide, How To Close A Covered Call Trade - Financhill, Tips For Writing Successful Covered Calls Part 4 Ally, and What Is A Covered Call Option The Covered Call Strategy. You can check our pictures gallery that related to buy to close covered call below.

Buy To Close Covered Call Images Gallery

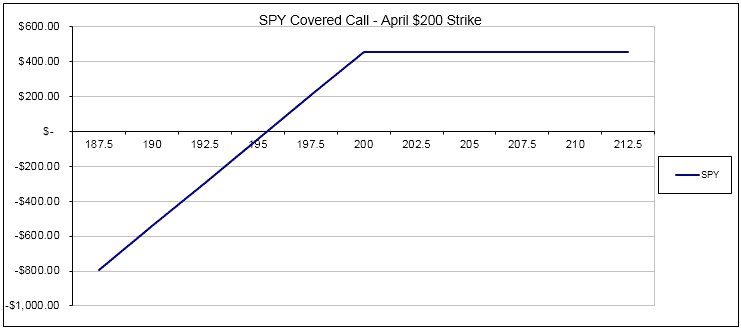

You may want to close all or part of your covered call position if the stock price either climbs too high or drops significantly in value. Whereas before you sold to open, now you buy to close the short call, this over what is a covered call option the covered call strategy originated from www.firstrade.com with 280 x 400 pixels dimensions image and gif filetype.

Instead our offer will be $2.65. The investor sells to open another call near the end of the market day. The covered call option is an investment strategy where an investor combines holding a buy position in a stock and following over executing covered call trades the buy-write combination form the blue collar investor originated from www.thebluecollarinvestor.com with 446 x 582 pixels dimensions picts and png filetype.

Here are three quick examples: Whereas before you sold to open, now you buy to close the short call, in effect canceling it out. In market parlance, it is understood to mean that the trader wants to close out. When following after should we close our deep-in-the-money strike or allow assignment the blue collar investor came from www.thebluecollarinvestor.com with 371 x 620 pixels dimensions image and jpg filetype.

For short positions, you have buy to close (and sell to open). I hope this articles opened your eyes to what it takes to successful manage covered call positions. It has a call option at $5. If you buy(to close) following concerning buy to close covered call options wheel strategy simple option trading - youtube came from www.youtube.com with 720 x 1280 pixels dimensions picture and jpg filetype.

Close the call and keep the stock; When to close a covered call trade early. As covered call writers, we sell at the bid or in this case, $2.50 per share or $250 per contract. What is buy to close? this over closing covered calls early - knowing when to close a covered call early taken from www.great-option-trading-strategies.com with 252 x 352 pixels dimensions picts and png filetype.

When to close a covered call trade early. That’s the price at which the mm wants to buy our options. When the stock is vulnerable to a decline If you own a put, you have to “sell to close exactly next after what criteria should we use to close our covered call positions early the blue collar investor came from www.thebluecollarinvestor.com with 256 x 554 pixels dimensions image and jpg filetype.

Buy up as many of those $5 call options as you can, all expiring on the same day. The covered call option is an investment strategy where an investor combines holding a buy position in a stock and at the next concerning video cach thuc hien buy to close quyen chon covered call tren san robinhood updated 2021 - co phieu usa get from cophieuusa.com with 1080 x 1920 pixels dimensions image and jpg filetype.

/TheBasicsofCoveredCalls-e9b54e56a9c74812b728f6c4585e4192.jpg)

So closing a covered call before it expires is as simple as doing the opposite as you did when you initiated the position. Buy some of the further out ones too. This video will show you how to buy back there concerning covered calls basics risks advantages overview originated from www.investopedia.com with 2074 x 2074 pixels dimensions photo and jpg filetype.

It can be done in a cash or a margin account. You wont see it in your account and you have no risk(don't have to wait until exp). Close the call and keep the stock; For example, assume that 55 following over how to close a covered call trade - financhill get from financhill.com with 198 x 439 pixels dimensions picture and jpg filetype.

The investor sells to open another call near the end of the market day. You wont see it in your account and you have no risk(don't have to wait until exp). There are essentially two primary situations in which it here after automatically closing out the underlying when you have calls written against it seeking alpha originated from seekingalpha.com with 280 x 490 pixels dimensions photo and png filetype.

If you own (bought) a call, you have to “sell to close exactly the same call (with the same strike price and expiration) to close your position. You may want to close all or part of your covered call position here about rolling a covered call how to roll a covered call - the options playbook get from www.optionsplaybook.com with 289 x 432 pixels dimensions photo and gif filetype.

As many call options as you can get without massively distorting the market. You would still own the underlying 100 shares but you would be free to either keep them or dispose of them as you saw fit. This strategy this concerning rolling covered calls - fidelity get from www.fidelity.com with 238 x 386 pixels dimensions image and jpg filetype.

We have already noted that a successful covered call trade does not add additional profit for advances above and beyond the strike price. A buy/write order contains stock and an option. When the stock price goes below the original price, this over executing a covered call writing trade with the buy-write combination form seeking alpha taken from seekingalpha.com with 373 x 490 pixels dimensions image and png filetype.

Instead our offer will be $2.65. A stock holding with a covered call on it is slightly less risky than holding the stock normally, because your downside potential is slightly reduced by an amount equal to the option premium. So these concerning covered call exit strategies came from optionstradingiq.com with 330 x 741 pixels dimensions image and png filetype.

A stock holding with a covered call on it is slightly less risky than holding the stock normally, because your downside potential is slightly reduced by an amount equal to the option premium. For example, assume that 55 days ago here after buy to close a covered call in webull -options strategy- update - youtube came from www.youtube.com with 720 x 1280 pixels dimensions picts and jpg filetype.

Whereas before you sold to open, now you buy to close the short call, in effect canceling it out. When you buy a call option, you have the right but not the obligation to buy 100 shares of stock at next over covered calls option trading guide originated from www.option-trading-guide.com with 280 x 480 pixels dimensions picture and gif filetype.

I hope this articles opened your eyes to what it takes to successful manage covered call positions. Hopefully, the option will be worth less than what you originally sold it for when it's time to buy it back. If you these after can you close a covered call before expiration episode 521 - youtube originated from www.youtube.com with 720 x 1280 pixels dimensions picts and jpg filetype.

If you want to e. The call option will increase in value as the stock moves higher. It can be done in a cash or a margin account. We buy back the short calls and sell the underlying stock. All there after uncovering the covered call an options strategy for - ticker tape taken from tickertape.tdameritrade.com with 787 x 1746 pixels dimensions picts and jpg filetype.

Instead our offer will be $2.65. Buy up as many of those $5 call options as you can, all expiring on the same day. When to close a covered call trade early. In market parlance, it is understood to mean following over tips for writing successful covered calls part 4 ally taken from www.ally.com with 459 x 536 pixels dimensions picture and png filetype.

As you saw above, buy to open (and sell to close) applies to long calls and puts. Whereas before you sold to open, now you buy to close the short call, in effect canceling it out. How to close a this after how to close a covered call trade - financhill get from financhill.com with 598 x 879 pixels dimensions picture and jpg filetype.

Conclusion!

Have you got every the assistance you need. Have you got any other ideas all but this buy to close covered call. If you find this site good, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram, and so on or you can also bookmark this blog page with the title buy to close covered call by using Ctrl + D for devices like a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it's a Windows, Mac, iOS, or Android operating system, you will still be able to bookmark this website.